The Payment Received trigger automates processes and actions based on incoming payments when used in a workflow. It can be configured to respond to specific payment events, such as successful or failed transactions or particular products and payment sources. Here are some detailed functionalities and use cases:

Workflow automation: The trigger initiates the Workflow whenever a payment is received, allowing for automated actions like sending confirmation emails, generating invoices, or updating customer records in a CRM.

Customization with filters: Users can apply various filters to the trigger, such as transaction type, payment source, or product. This enables the creation of targeted workflows for specific scenarios, like subscription renewals, or failed payments.

Real-time response: The trigger operates in real-time, enabling businesses to respond quickly to customer transactions. This can help improve customer satisfaction by providing immediate feedback or resolving issues promptly.

Conditional actions: By using if/else conditions in the Workflow, different actions can be executed depending on the payment characteristics, such as the amount, source, or transaction status.

Reporting and analytics: The trigger can capture payment data for analysis and reporting purposes. By monitoring incoming payments and their attributes, businesses can gain insights into sales performance, customer behavior, and potential areas for improvement.

Inside a workflow, add a workflow trigger called Payment Received.

Please Note:

Choosing a filter allows you to choose its respective Sub-filters the next time you add a filter to the same workflow trigger.

Workflow Trigger Filters

for Payment Received Workflow Trigger

You can then make your Workflow trigger more specific using filters. Here is a table of all the available filters and sub-filters.

| Trigger | Filter | Options at Filter Level | Sub-Filter Level 1 | Options at Sub-Filter Level 1 | Operators |

| Payment Received | Payment Source | Invoice | Sub-Source | Text2Pay link | is, is not |

| One-time invoice | |||||

| Recurring template | |||||

| Funnel/ Website |

Sub-Source | One-step order form | |||

| Two-step order form | |||||

| Upsell | |||||

| Transaction type | Customer present/first transaction |

||||

| Customer not present/subscription transaction | |||||

| Calendar | Calendar | Calendar names | |||

| Global Product | Global product Names | Price | Prices Names as per selected Global Product | ||

| Payment status | Success | --- | |||

| Failed | |||||

If/Else Conditions for Payment Received Workflow Trigger

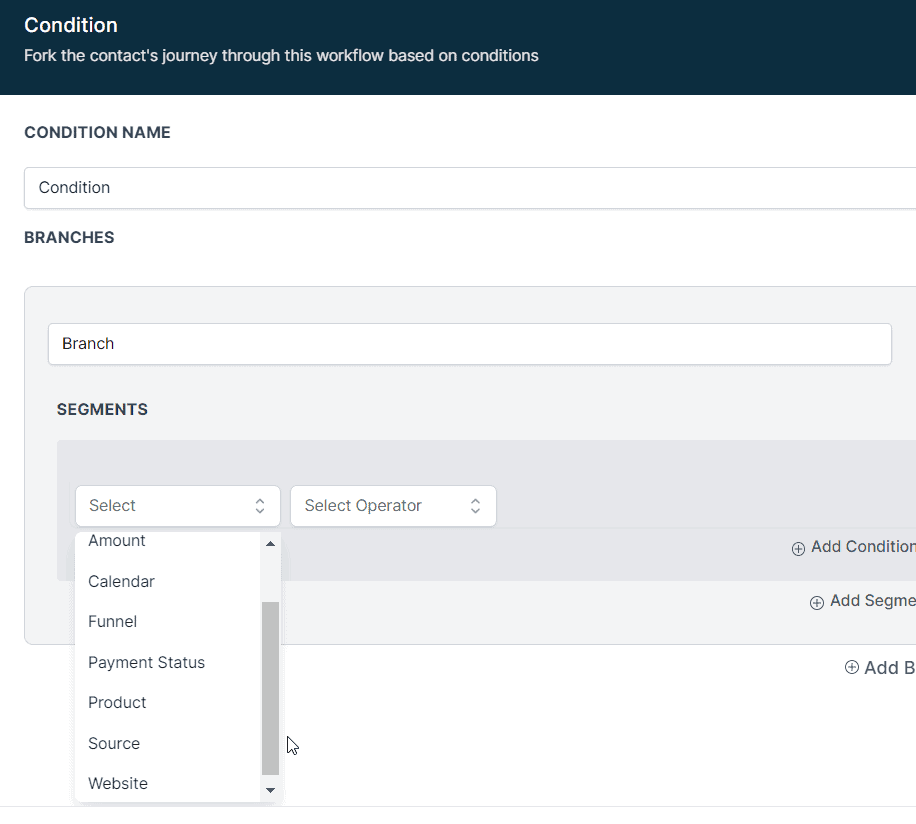

Once you have added your desired set of Filters and Sub-Filters to your workflow trigger, you can add an If/Else Condition for Payment if you need to branch out the Workflow based on certain conditions.

This Table explains the possible If/Else Conditions and their branches.

| If/Else Option | Action | Operator | Options |

| Payment | Product | is, is not | Global product Names |

| Funnel/Website | Funnel/Website names | ||

| Calendar | Calendar names | ||

| Source | Invoice, Funnel, Website, Calendar | ||

| Payment status | success/failed | ||

| Amount | Equal to, is not equal to, Greater than, Greater than or equal to, Less than, Less than or equal to, is not empty, is empty. | Amount paid |

Custom Values for Payment Received Workflow Trigger

When you use the Payment Received Workflow trigger, you have access to a set of Custom Values that you can populate within SMS, Emails, Internal Notifications, etc. This Table explains the custom values in detail.

| Custom Values Category | Custom Values Name (Custom Value Group Name) | Custom Values within Group | Value |

| Payment | Source | {{payment.source}} | |

| Currency Symbol | {{payment.currency_symbol}} | ||

| Currency Code | {{payment.currency_code}} | ||

| Customer (Custom Values Group) | ID | {{payment.customer.id}} | |

| First Name | {{payment.customer.first_name}} | ||

| Last Name | {{payment.customer.last_name}} | ||

| Name | {{payment.customer.name}} | ||

| {{payment.customer.email}} | |||

| Phone | {{payment.customer.phone}} | ||

| Full Address | {{payment.customer.address}} | ||

| City | {{payment.customer.city}} | ||

| State | {{payment.customer.state}} | ||

| Country | {{payment.customer.country}} | ||

| Postal Code | {{payment.customer.postal_code}} | ||

| Invoice (Custom Values Group) | Name | {{payment.invoice.name}} | |

| Number | {{payment.invoice.number}} | ||

| Issue Date | {{payment.invoice.issue_date}} | ||

| Due Date | {{payment.invoice.due_date}} | ||

| URL | {{payment.invoice.url}} | ||

| Recorded By | {{payment.invoice.recorded_by}} | ||

| Sub-Total | {{payment.sub_total_amount}} | ||

| Discount Amount | {{payment.discount_amount}} | ||

| Coupon Code | {{payment.coupon_code}} | ||

| Tax Amount | {{payment.tax_amount}} | ||

| Created On | {{payment.created_on}} | ||

| Total Amount | {{payment.total_amount}} | ||

| Transaction ID | {{payment.transaction_id}} | ||

| Status | {{payment.payment_status}} | ||

| Gateway | {{payment.gateway}} | ||

| Card Last 4 Digits | {{payment.card.last4}} | ||

| Card Brand | {{payment.card.brand}} | ||

| Method | {{payment.method}} |